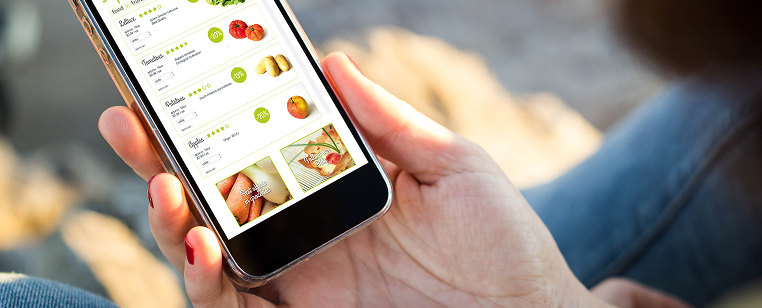

An electronic wallet usually called a “Future wallet” or “e-wallet”

is an electronic adaptation of an installment card which is approved

to lead exchanges for your sake. These wallets are for the most part

on a cell phone, for example, a cell phone, however, work areas and

PCs can hold an electronic too.

Electronic wallets must be connected to explicit charge or Visas

to work appropriately. There might be a necessity to connect the

e-wallet to a financial balance too. At that point, using data and

programming, customers can utilize their electronic wallet to pay

for things as opposed to conveying a physical wallet to pay with a

card.

NRTC is one of the best fresh fruit company in Dubai. NRTC

endeavors to be the provider of decision, conveying astounding

client care, delivering quality cleaned and handled Fruits and

Vegetables, executing business morally, keep on being a pioneer in

advancement and administrations in the new produce supply

industry. NRTC has gone through all these following aspects before

letting our valuable customers go for transaction or any credits

are charged online:

Advantages of E-Wallets:

It offers more accommodation for every customer:

At the point when you're conveying an electronic wallet, you find

quite many cards you have to deal with when you are traveling. You

never have to carry a great deal of money with or cards again

while traveling. You should simply tap your cellphone or any other

device, or just scan the given code, and the payment will be

transferred or received online with just a matter of seconds. That

implies you're never going anywhere with a pocketful of things

anywhere you go.

It gives access to vast kinds of cards:

Electronic wallets ordinarily store Mastercards and platinum

cards. They can be utilized for a wide assortment of cards,

nonetheless, if the supplier is good with the wallet you are

utilizing. That implies you can store rewards cards, dependability

cards, and even coupons inside your computerized wallet,

permitting you to appreciate to a greater extent a paperless way

of life.

It offers greater security overall:

On the off chance that you have a great amount of money in your

pocket that gets lost, you have zero choices accessible to you to

recoup your assets. Losing your cash cards implies you should

contact every moneylender to drop each card, at that point have

another one issue. With an electronic wallet, the data is put away

through an outsider supplier. It’s bolted behind your secret key

or biometrics. Regardless of whether you lose your gadget, you’ll

despite everything approach your e-wallet once you get another

gadget.

It could assist you with your tight budget:

Numerous electronic wallets can assist you in following your ways

of managing money. Some may produce reports that give you explicit

classifications of spending. You can likewise allot fixed spending

plans to explicit cost classifications to guarantee that you’re

not spending more than you ought to on specific things. In the

event that you have a first-class thing to buy, in any case, you

can cripple this component to make sure there’s sufficient cash

accessible to make the installment.

It expects clients to approve each transaction:

Electronic wallets work like a charge card while starting an

exchange. They expect you to include your PIN to approve

installment. For gadgets with biometrics, an installment would

require your unique mark to approve it. That gives you another

layer of protection from unapproved buys or the money related

dangers related to data fraud.

All these advantages or pros shows the amazing evolution of

technology that made all the worries about being unable to go to

any market or buying any item online for us or our dear ones.

Apart from its cons this technology is perfect for the most part,

the utilization of a computerized wallet is a helpful alternative

for some individuals.

NRTC is one of the best fresh fruit company in Dubai. NRTC

endeavors to be the provider of decision, conveying astounding

client care, delivering quality cleaned and handled Fruits and

Vegetables, executing business morally, keep on being a pioneer in

advancement and administrations in the new produce supply

industry. NRTC has gone through all these following aspects before

letting our valuable customers go for transaction or any credits

are charged online:

Advantages of E-Wallets:

It offers more accommodation for every customer:

At the point when you're conveying an electronic wallet, you find

quite many cards you have to deal with when you are traveling. You

never have to carry a great deal of money with or cards again

while traveling. You should simply tap your cellphone or any other

device, or just scan the given code, and the payment will be

transferred or received online with just a matter of seconds. That

implies you're never going anywhere with a pocketful of things

anywhere you go.

It gives access to vast kinds of cards:

Electronic wallets ordinarily store Mastercards and platinum

cards. They can be utilized for a wide assortment of cards,

nonetheless, if the supplier is good with the wallet you are

utilizing. That implies you can store rewards cards, dependability

cards, and even coupons inside your computerized wallet,

permitting you to appreciate to a greater extent a paperless way

of life.

It offers greater security overall:

On the off chance that you have a great amount of money in your

pocket that gets lost, you have zero choices accessible to you to

recoup your assets. Losing your cash cards implies you should

contact every moneylender to drop each card, at that point have

another one issue. With an electronic wallet, the data is put away

through an outsider supplier. It’s bolted behind your secret key

or biometrics. Regardless of whether you lose your gadget, you’ll

despite everything approach your e-wallet once you get another

gadget.

It could assist you with your tight budget:

Numerous electronic wallets can assist you in following your ways

of managing money. Some may produce reports that give you explicit

classifications of spending. You can likewise allot fixed spending

plans to explicit cost classifications to guarantee that you’re

not spending more than you ought to on specific things. In the

event that you have a first-class thing to buy, in any case, you

can cripple this component to make sure there’s sufficient cash

accessible to make the installment.

It expects clients to approve each transaction:

Electronic wallets work like a charge card while starting an

exchange. They expect you to include your PIN to approve

installment. For gadgets with biometrics, an installment would

require your unique mark to approve it. That gives you another

layer of protection from unapproved buys or the money related

dangers related to data fraud.

All these advantages or pros shows the amazing evolution of

technology that made all the worries about being unable to go to

any market or buying any item online for us or our dear ones.

Apart from its cons this technology is perfect for the most part,

the utilization of a computerized wallet is a helpful alternative

for some individuals.